Online scams don’t pop up randomly; they cluster in a handful of high-risk regions. This report spotlights the top 10 fraud countries in the world, explains why they dominate the cybercrime charts, and shows the hard numbers behind the headlines. Read on to see who tops the list, and how that knowledge can save your bottom line.

The World Wide Web is extremely unequal when it comes to fraud. Some countries have earned unsavory reputations as sources of online scams due to lax enforcement, highly organized cybercriminal gangs, or high numbers. Here we present the top 10 countries spearheading fraud activity in 2025, according to data from the FTC (U.S. Federal Trade Commission), INTERPOL, and Europol.

Known for: romance scams and business email compromise (BEC).

Nigeria remains a premier source of email scams and false inheritance schemes. Many operations are run by highly technical local gangs and target persons and businesses worldwide.

According to 2023 reports by the FTC, victims of romance scams have suffered more than $1.1 billion in losses, and a good portion of these were West African offenses, including Nigerian ones.

Known for: Tech support scams, IRS impersonation.

India is famous for scam call centers pretending to be tech support or government agencies. Many of them target English-speaking countries, especially the U.S. and the U.K.

According to the Internet Crime Complaint Center (IC3) report of the FBI, in 2023, more than 88,000 complaints were filed regarding tech support fraud, with losses topping $847 million, India being one of the chief origin points for such operations.

Known for: Banking trojans, ransomware, phishing.

Russia is home to some of the world’s most dangerous hacker groups. Many of these entities operate under the protection of the state by launching large-scale financial and ransomware attacks.

According to Mandiant’s 2024 M-Trends report, financially motivated cyberattacks accounted for a good share of attacks perpetrated by Russian-speaking threat actors, and ransomware was at the top of the cyberattack list as LockBit, a group with alleged Russian ties, had extorted more than $100 million worldwide before being recently disrupted.

Known for: Fake eCommerce sites, counterfeit product listings.

Fraud in China mostly comes under the category of product-level. The party under review may either give fake reviews, ship the counterfeits, or even fake the whole storefront!

According to U.S. Customs and Border Protection (CBP) data, during fiscal year 2023, over 20,000 seizures of counterfeit goods took place with an estimated MSRP value of over USD 2.6 billion. China (including Hong Kong) was consistently listed as the primary source country.

Known for: Payment fraud, cloned cards.

Mexico’s financial fraud often involves stolen credit card data and fraudulent use in eCommerce. Organized groups collaborate across borders to sell fraud-as-a-service.

Europol’s 2023 Internet Organised Crime Threat Assessment (IOCTA) highlights how Mexican organized crime groups are increasingly involved in sophisticated financial fraud schemes across Latin America and Europe. However, specific monetary figures for Mexico alone are challenging to isolate from broader transnational operations.

Known for: Ponzi schemes, crypto scams.

In their typical modus operandi, Pakistani fraudsters use digital wallets and cryptocurrencies to fleece naive investors, promising fake ROIs. Although country-level figures for crypto fraud are usually not disclosed by regulatory agencies, the Pakistan Telecommunication Authority (PTA) claimed that it blocks thousands of fraudulent websites and apps yearly, many related to Ponzi and crypto scams.

In 2023, for instance, the PTA blocked more than 1,200 fraudulent URLs connected to financial scams.

Known for: Credit card fraud, digital wallet hacks.

Brazil is a hotbed for cloned cards, payment data theft, and fraud-as-a-service targeting local and international users. A 2024 report by a major cybersecurity firm indicated that Brazil accounts for approximately 20% of all online fraud attempts in Latin America, with a high concentration on payment card fraud and digital wallet compromises.

Known for: Job scams, phishing through social platforms.

Indonesian scammers impersonate companies or government agencies to solicit money or personal data from job seekers. Online scams, including job scams, accounted for over 15,000 reported cases in 2023, with losses estimated to be in the hundreds of billions of rupiah, according to the Indonesian National Police Cyber Crime Directorate.

Known for: Social engineering, identity fraud.

The Philippines is witnessing high social media scams, including fake profiles, phishing messages, and payment app scams. According to the Philippine National Police Anti-Cybercrime Group (PNP ACG), over 5,000 complaints were recorded within the first half of 2024 on online scams, social media frauds, and identity theft, among the major categories.

Known for: financial malware and phishing networks.

While the war goes on, fraudulent activity in Ukraine still fluctuates between independent gangs or cybercriminals formerly cooperating with Russian actors. ESET 2023 Threat Report observed that despite the conflict, Ukraine remains a target and origin for various cybercrime activities, including banking malware.

For example, banking malware detection rates in Ukraine have remained significantly higher than the global average in 2023, indicative of continued activity (the exact percentages may vary, but these are generally 2-3 times higher than the global average).

Not all fraud is equal, and not every country is prepared to fight against it. So what makes certain nations top global fraud lists?

Below are the key risk factors that increase the risk of fraud for a nation:

| Reason | Explanation |

|---|---|

| Weak Legal Enforcement | Scammers operate with near impunity when fraud laws are outdated or poorly enforced. Police often lack the resources to act, especially across borders. |

| Outdated or Insecure Technology | Countries with low cybersecurity investment or unpatched infrastructure are vulnerable. Fraudsters exploit weak digital defenses. |

| High Poverty and Unemployment Rates | Scamming can seem like a viable income source in regions with few job opportunities, especially among desperate or uneducated youth. |

| Organized Cybercrime Ecosystems | Some countries have large cybercrime rings supported by corruption. These networks are structured, well-funded, and hard to trace. |

| Poor Public Awareness | Without education on digital safety, people can’t spot fake websites or phishing attempts, making them easier targets for scams. |

| Weak Cross-Border Cooperation | Scammers often operate internationally, exploiting countries with minimal cooperation on cybercrime prosecution. |

When researching global fraud trends, I always look at reliable reports from key law enforcement and anti-fraud agencies. These sources help me piece together the global picture of fraud.

Scammers often pose as charming strangers on dating sites or social media, using fake identities and stolen photos to lure victims. They spend weeks building emotional connections and gaining trust.

Once the victim has an emotional attachment established, the scammers start inventing emergencies that demand money, with examples including medical emergencies and visa-related issues. Such stories appear private and urgent, increasing the likelihood of targets sending money.

Phishing emails would appear to be issued by a genuine company, warning the recipient about some fake account problem or suspicious login. They eventually lead to a link that either gets cute data or malicious software downloaded.

That is when the victim shares the password or unknowingly downloads malware that can compromise their device. A simple click could spell serious financial loss and identity theft.

Fraudsters steal card-related details through website breaches, fake payment sites, or card skimmers. They either use the information immediately or sell it before it is flagged.

Cardholders will often discover fraudulent charges too late, while the business on the other side finds itself embroiled in chargebacks and loses a substantive amount of revenue. It is a form of virtual theft that is very fast.

Scammers pitch legitimate high-return investment opportunities, often involving crypto, forex, or real estate. They use flashy websites, fake testimonials, and aggressive marketing.

At first, victims see “returns” on their investment, which builds confidence. But once they try to withdraw, the platform and their money disappear.

Fake online stores advertise unbeatable deals on popular products to lure shoppers. They put up sites that look real, often copying an actual brand, while AI-generated reviews lend them even further an air of legitimacy.

Once payment is completed, the victims either get counterfeit goods or nothing. Customer service becomes the darkest of silences, and there are almost no avenues to track a slight chance for a refund.

⭐ Top 11 eCommerce Fraud Types & Smartest Things Online Retailers Can Do

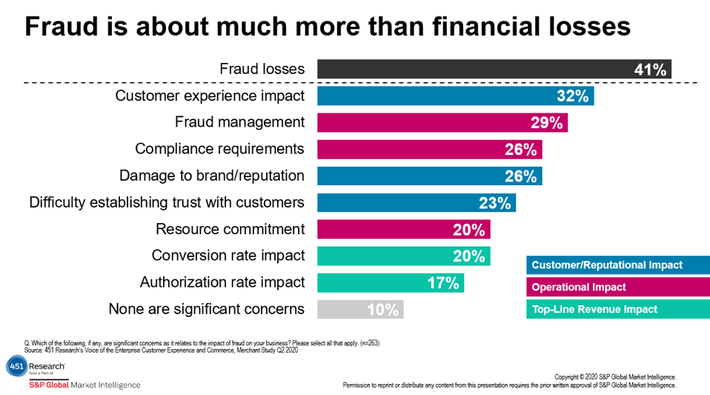

Fraud originating from these regions doesn’t just impact individuals; it hits global businesses hard in several ways.

Fake orders greatly drain business resources yet provide no real value. When fraudsters place such huge orders, companies lose inventory and the money to ship it out.

Over time, these fake sales begin throwing inventory out, wrecking forecasting and revenue-tracking. These repeated dips could wipe out the cash flow and any growth plan for small companies.

Bad guys exploit refund loopholes, insisting that goods were not delivered or arrived damaged. These chargebacks cost the most, in terms of their losses and fees.

Besides the fiscal loss, a chargeback rate eats away at a business’s reputation with its payment processor. Eventually, it will earn a business higher fees, account holds, or even terminate its merchant account.

Source: Forbes

Customers start doubting the brand if fraud originates in the store, with or without intention. A single incident involving theft of credit card data or unlawful charges on the data can go a long way to breaking brand credibility.

As trust fades, formerly loyal customers hesitate to make a repeat purchase. They might begin writing bad reviews or switching to a competitor, causing further long-term damage to the brand beyond the immediate question.

Mass fraud attempts can overwhelm backend systems, slowing services or forcing emergency shutdowns. For SaaS and eCommerce platforms, this can mean hours or days of costly downtime.

IT teams are forced to divert resources toward emergency patches or fraud cleanup. This slows innovation and leaves the door open for future attacks.

Given these threats, it’s essential for businesses to proactively defend themselves against fraud originating from high-risk regions. Here’s how you can protect your operations:

Advanced tools like Blockify help detect suspicious behavior before damage is done. They track behavior patterns and identify red flags using AI and real-time analytics.

With automated rules and risk scoring, Blockify can stop fraud before it reaches checkout. It’s one of the simplest ways to add an extra layer of defense without draining resources.

Knowing where your users come from is crucial. IP geolocation lets you spot high-risk regions and block or flag suspicious traffic.

For example, geo-blocking can limit exposure and reduce threat surface instantly if your store rarely serves a specific country with high fraud reports.

Use custom rules to hold or review orders from flagged regions. You can filter by billing–shipping mismatch, order size, or unusual buying patterns.

Blockify lets you hold or auto-review these risky orders before they reach fulfillment, saving you time, money, and chargeback headaches.

>>> Read more: Shopify High-risk Orders: Should You Fulfill This Order?

Keeping an eye on live purchases lets you spot fraud spikes fast. Real-time monitoring reveals unusual surges, bot activity, or repeated failed checkouts.

Combined with alerts and dashboards, your team can react instantly, shutting down bad actors before they wreak havoc.

If you’re navigating international sales, especially in regions with high fraud risks, these are some key questions merchants often ask:

Yes, if you’re smart about it. Setting fraud filters such as IP geo-location, velocity checks, and manual review of suspicious transactions could prevent an entire region from being blocked. Otherwise, you could end up blocking legitimate buyers.

Three big trends in welding that are drawing attention: deepfake voice scams, AI-obsessed phishing emails, and synthetic identity fraud.

Traditional tools make These harder to detect, so it’s critical to upgrade to fraud prevention systems that use behavioral analytics and machine learning.

Not necessarily. Blocking entire countries will ease your headaches only in the short term and diminish what could be good sales. Use smart filters to scan for risky behavior rather than paint all customers with the same brush.

Conclusion

Borders don’t confine fraud, but it certainly has favorite launchpads. Nigeria’s romance rings, India’s tech-support call centers, and Russia’s ransomware crews all illustrate how local conditions fuel global scams. Weak enforcement, thriving cybercrime ecosystems, and economic pressure turn these regions into international fraud hubs.

Armed with the latest data, you can tailor defenses: deploy tools like Blockify, enforce 3-D Secure, and review high-risk orders with extra scrutiny. Stay vigilant, update your fraud filters, and keep revenue flowing while scammers hit the wall, no matter which “fraud country” they call home.