Every eCommerce store faces the risk of many fraud types, but not everyone tracks it properly. One of the most important metrics to watch is your fraud-to-sales ratio. This simple number can reveal how much of your revenue is at risk and help you take action before it’s too late. In this guide, we’ll break down what the ratio means, how to calculate it, what’s considered “too high,” and what you can do to bring it down.

The fraud-to-sales ratio indicates the revenue of a store that is affected by fraudulent transactions. It compares the value of fraudulent orders with total sales and then expresses the ratio as a percentage.

In simpler terms, it shows you how often fraud eats into profits.

Suppose in your store, you had $100,000 in sales, with $2,000 of them being fraudulent orders. That would mean that the fraud-to-sales ratio stood at 2%, symbolizing that 2% of your revenues are either at risk or have been lost to fraud.

The formula is simple:

Fraud-to-Sales Ratio = (Total Fraudulent Transactions ÷ Total Sales) × 100

The result is a percentage of your sales affected by fraud; thus, the larger the number, the more revenue is lost through fraud.

Example:

You processed $50,000 in sales last month in your store, whereas $1,000 worth of orders were flagged as fraudulent.

Fraud-to-Sales Ratio = (1,000 ÷ 50,000) × 100 = 2%

So, 2% of your revenue got lost to fraud. Now, that is quite alarming.

There is no universally “perfect” fraud-to-sales ratio, but some general guidelines most experts agree on:

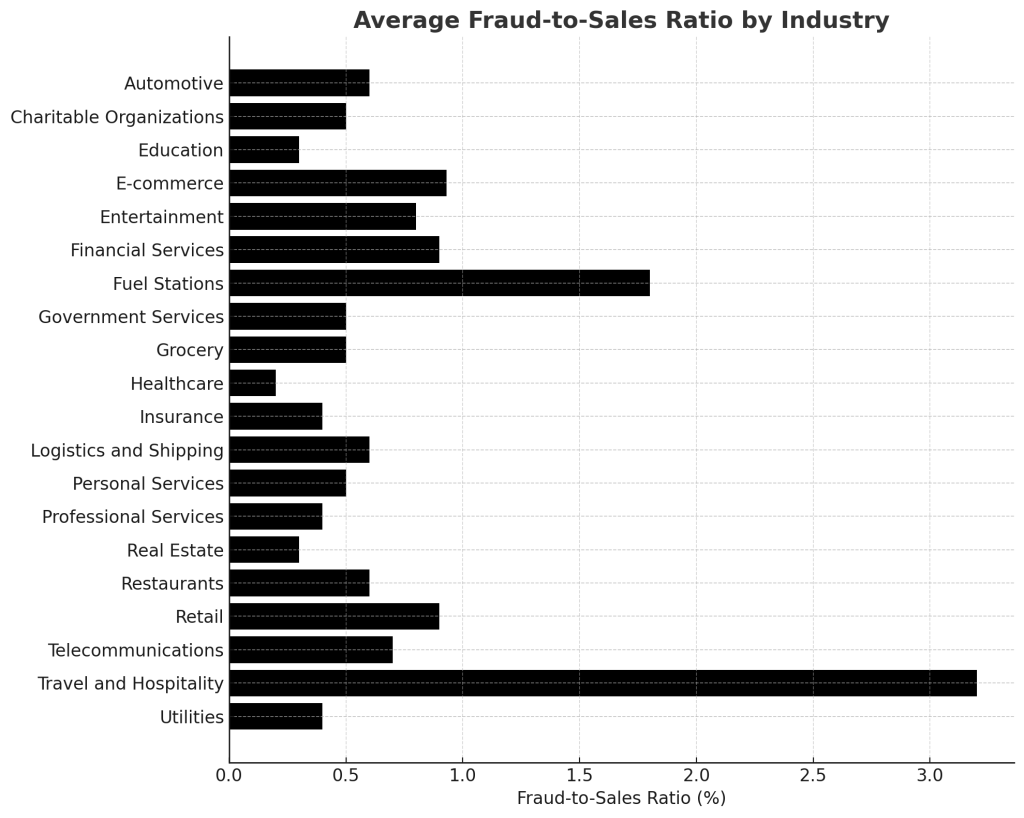

According to fraud risk data published by Clearly Payments, different industries face varying levels of exposure to fraudulent transactions. Their research provides average fraud-to-sales ratios across multiple sectors, helping businesses benchmark their performance and evaluate risk. The numbers below reflect typical chargeback or fraud rates businesses might experience depending on their niche.

| Industry | Average Fraud-to-Sales Ratio |

|---|---|

| Automotive | 0.60% |

| Charitable Organizations | 0.50% |

| Education | 0.30% |

| E-commerce | 0.93% |

| Entertainment | 0.80% |

| Financial Services | 0.90% |

| Fuel Stations | 1.8% |

| Government Services | 0.50% |

| Grocery | 0.50% |

| Healthcare | 0.20% |

| Insurance | 0.40% |

| Logistics and Shipping | 0.60% |

| Personal Services | 0.50% |

| Professional Services | 0.40% |

| Real Estate | 0.30% |

| Restaurants | 0.60% |

| Retail | 0.90% |

| Telecommunications | 0.70% |

| Travel and Hospitality | 3.2% |

| Utilities | 0.40% |

Some data show that Travel and Hospitality is the riskiest industry with a fraud-to-sale ratio of 3.2%. This is because of the large value of transactions and easy cancellations. Healthcare, by contrast, is the least risky, with just a 0.2% fraud rate, due to rigorous verification procedures and less exposure to fraudulent acts.

A high fraud-to-sales ratio doesn’t just reflect lost revenue, it signals deeper issues that can damage your store’s financial health, customer trust, and long-term growth.

A chargeback almost always follows any fraudulent transaction. This means, apart from losing the product and payment, there is also a fee for processing that cannot be refunded. Processing fees range from $15 to $100 per case, which really add up for stores with recurring fraud issues.

Chargebacks can eventually eat into your profits, especially when chargebacks pertain to big-ticket items or stores with a thin margin. Payment processors may view this pattern unfavorably and respond by either increasing your fees or even blocking your ability to process specific transactions.

Payment processors and gateways closely monitor fraud metrics, including chargeback ratios. If your fraud-to-sales ratio crosses their acceptable threshold (typically around 1%), your account may be flagged as high risk.

Once this happens, funds may be frozen, payouts delayed, or in some cases, your payment gateway terminated. Getting blacklisted also deters future banks and payment gateways from partnering with you, which makes the continuation of your business that much more difficult.

The premise of an eCommerce business is that consumers expect a safe shopping experience, especially when it comes to the payment process; once your store is marked for fraud cases, whether it is due to data leaks, stolen credit cards, or chargeback disputes, shoppers are going to rule out doing business with you.

One bad wave can put a dent in your brand’s reputation, especially if that negative word is carried through reviews or social channels.

Keeping the fraud-to-sales ratio in check is more about developing a system that actively detects and prevents fraud before it occurs. Here are four ways you can do it.

Investing in fraud detection tools like Blockify can help you automatically flag risky transactions. These systems use machine learning and behavioral data to assess risk in real time.

Blockify is specifically built for Shopify and Wix merchants to block false checkouts, detect suspicious activity in real time, and stop high-risk orders from going through. It’s a lightweight solution running silently in the background, with no need for manual review or setup.

High-ticket orders often attract fraudsters looking for a big payout. That’s why it’s essential to manually verify expensive purchases, especially if they come from new customers or unusual locations.

You can send a quick verification email, call the customer, or request additional ID if needed. A short delay in fulfillment is a small price to pay to avoid a major loss.

Keeping an internal blacklist of suspicious IP addresses, email domains, or billing addresses can help prevent repeat fraud attempts. Many eCommerce platforms let you block or flag these during checkout.

Over time, this creates a stronger defense system. You can even integrate blacklists with fraud detection tools for automated protection across all orders.

Velocity checks help detect unusual patterns, like multiple orders placed in a short period from the same card or IP. These behaviors often signal bot activity or stolen card testing.

Adding IP monitoring can further alert you to high-risk geolocations or proxy use. When combined, these tools give you better visibility and control over fraudulent attempts.

Implementing multi-factor authentication (MFA) at checkout can stop unauthorized transactions before they happen. This may include one-time passcodes, biometric ID, or verified logins.

While it adds a slight step for customers, it significantly reduces the risk of stolen card use. Many fraudsters abandon carts when they hit an authentication wall.

Keep an eye out for irregular buying patterns, such as sudden spikes in order volume, mismatched shipping/billing addresses, or overnight purchases from new customers. These are classic signs of fraudulent activity.

Set up alerts or reporting dashboards that flag this behavior in real time. Early detection gives you a chance to cancel orders before they cause chargebacks.

Sometimes, the best fraud prevention comes from human judgment. Train your customer support and fulfillment teams to recognize red flags like suspicious emails, duplicate orders, or rush shipping with vague contact info.

When your whole team is aware of what fraud looks like, you create multiple layers of defense, not just technical ones.

Conclusion

The fraud-to-sales ratio is more than just a number, it’s a direct reflection of your store’s risk exposure and operational health. Keeping this metric under control means protecting your revenue, your reputation, and your long-term growth.

Take the time to audit your store’s fraud prevention setup and monitor this ratio regularly. A few smart safeguards today can save you from major losses tomorrow. Start protecting your store with Blockify today!