The classic image of a shoplifter may seem outdated, but theft hasn’t disappeared, it has simply evolved. Refund fraud is now one of the most common yet overlooked threats, happening faster, smarter, and often undetected in the digital age. This article comes equipped with everything one needs to know about return fraud and how to prevent it moving forward.

Return fraud is essentially taking undue advantage of the return policy of a retailer. Such policies are created for a customer’s benefit and will be misused by dishonest people to secure free products or money.

This form of fraud is called friendly fraud if it is brought about by buying an item with the intent to use the product before returning it. Both types of merchants are vulnerable; however, online retailers are particularly at risk because of the model of their business.

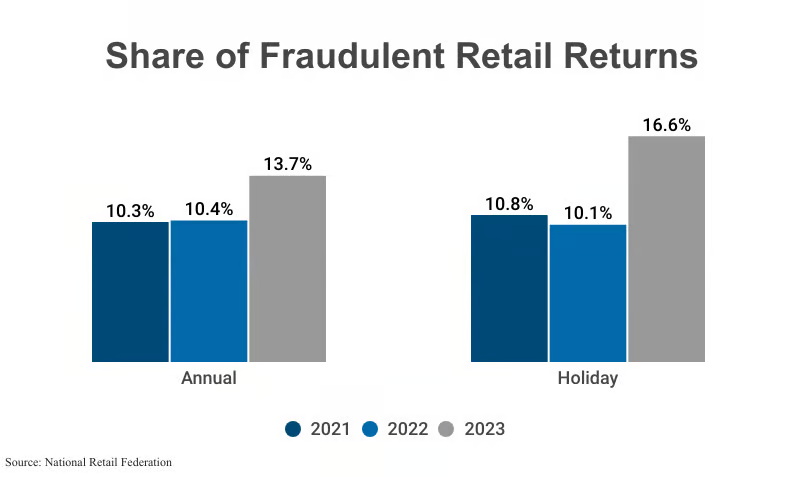

Return fraud is an expanding issue within scams and criminal activities. The following statistics from the National Retail Federation highlight the widespread impact of this problem on e-commerce businesses:

As reported by the National Retail Federation (NRF), return fraud costs retailers $10.40 for every $100 accepted in merchandise returns.

By the way, return fraud refers to those fraudulent returns in which customers are believed to have not returned or received items. These lead to millions of unnecessary dollars spent on refund and replacement costs, in spite of the actual costs incurred to businesses while processing returns, such as shipping, packaging, and administrative costs, which are even more burdensome.

Fraudulent returns disrupt inventory tracking, causing discrepancies that lead to overstocking or stock shortages. Returns of items that are damaged or devalued, particularly in cases of fraud, cannot be resold at the full price, thereby creating another dent in revenue. Poor inventory accuracy can also hamper restocking decisions while strangling the effectiveness of the overall supply chain.

Retailers may set in place a strict return policy to address return fraud, which can sometimes aggravate legitimate customers and affect their shopping experience. Such an environment saturated with rigid regulations to return goods can paint a grim picture of an unwillingness to cooperate, casting negative publicity and potentially losing customers.

Finding this balance between fraud prevention and customer satisfaction is fundamental to sustaining trust and brand loyalty.

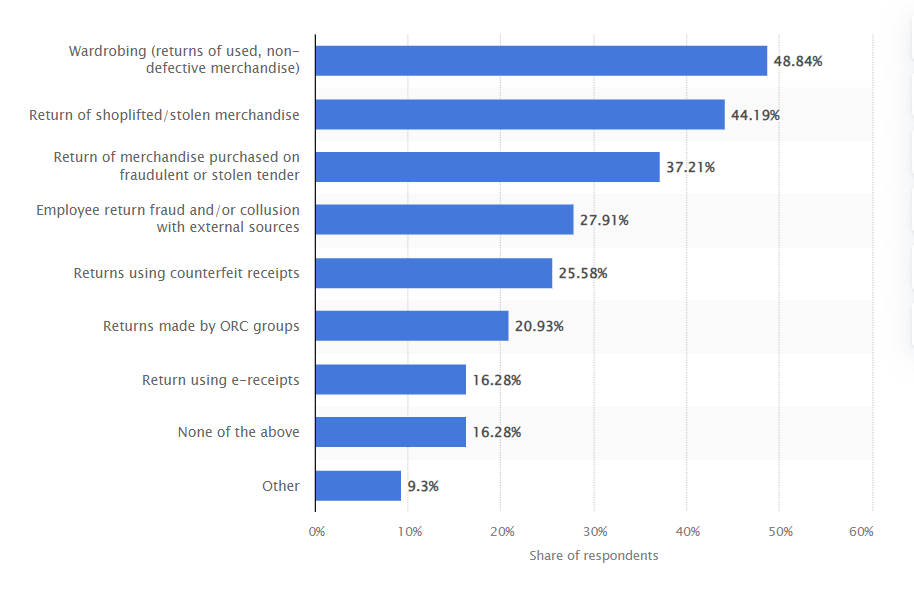

Refund fraud is another common nightmare that is extremely harmful to a retailer’s profits. More so, it includes a variety of fraudulent acts, namely returning for unlawful benefit. Here are some common refund frauds:

(Source: Statista)

1. Wardrobing: This means buying the goods, generally clothing or electronics, using them, and returning them for a full refund. It is somewhat akin to renting the goods free of charge under a fictitious purchase pretense.

2. Receipt Fraud: Receipt fraud can arise in a variety of manners, including but not limited to producing fake receipts, altering real ones, or returning the item based on real receipts that were issued for items that were never purchased.

3. Stolen Merchandise: The thieves produce the return of the stolen merchandise in order to receive money back or store credit and thus launder the stolen goods through returns.

4. Price Switching: Price switching is the practice of switching out the price tag of an item from a higher amount to a lower one at the point of sale and then returning it at the retail price for profit on the difference in pricing.

5. Bricking: This term means that customers replace parts or tamper with electronic devices prior to return.

6. Employee Fraud: Sometimes, employees exploit their position to process false returns and pocket the refund or collaborate with outsiders to facilitate fraudulent returns.

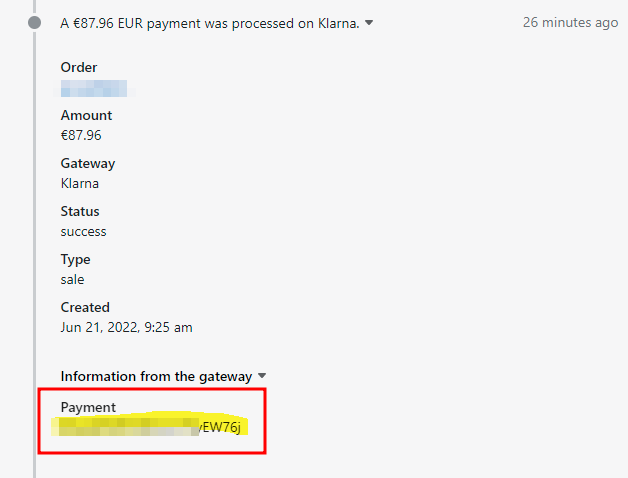

eCommerce return fraud examples:

There’s no single answer to why customers commit refund fraud. The motivations can vary widely, and not all cases are driven by malicious intent.

Some buyers may unknowingly commit fraud, simply unaware that they aren’t eligible for a refund. Others may resort to fraudulent returns out of frustration with a store’s policies. In some cases, a one-time accidental refund abuse might turn into repeated fraud once a customer realizes how easy it is to get away with it.

Return fraud represents more of a risk for an up-scaling business, and in essence, there is a need for advanced fraud detection systems. Advanced technology and analysis of data, however, facilitate real-time fraud detection and prevention. Here are the following ways:

Machine learning applies to large data sets of transactions to detect suspicious patterns that may get overlooked in a manual review. They continue to learn and ‘adapt’, which, of course, is more difficult for the fraudster.

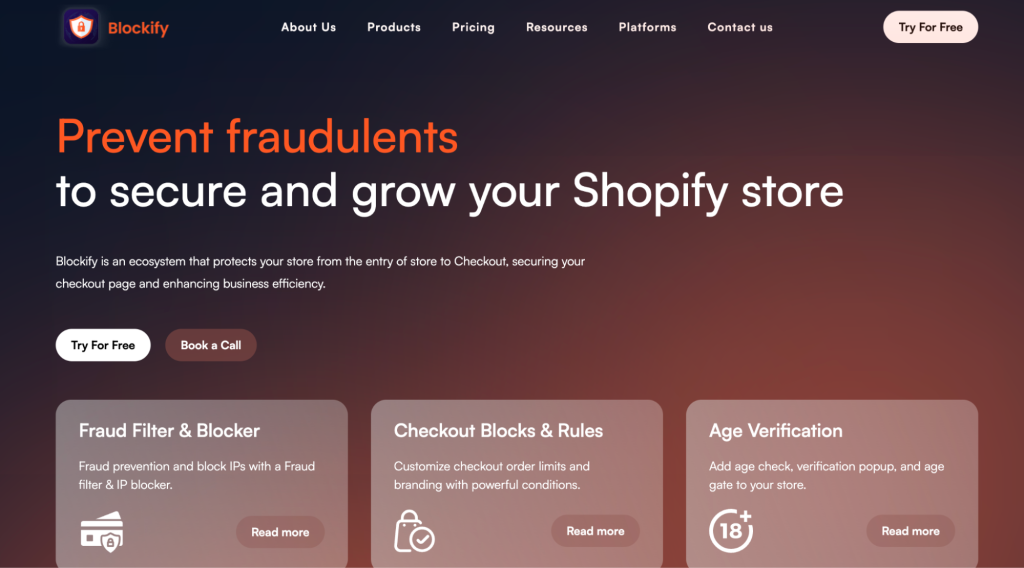

Tools like Blockify provide an automated service for detecting fraud orders whereby the retailer can block suspected high-risk transaction flows before they lead to refund fraud.

Keeping tabs on IP addresses, device details, and browsing activities uncovers inconsistencies that may indicate fraudulent behavior. Indicators like dynamic location changes or missing social media footprints may well serve as indicators.

Looking at the trend of a return transaction reveals common patterns of fraud, thereby assisting the identification of frequent offenders. By spotting trends, the business may create proactive measures to combat fraud and work on tactics that improve with time.

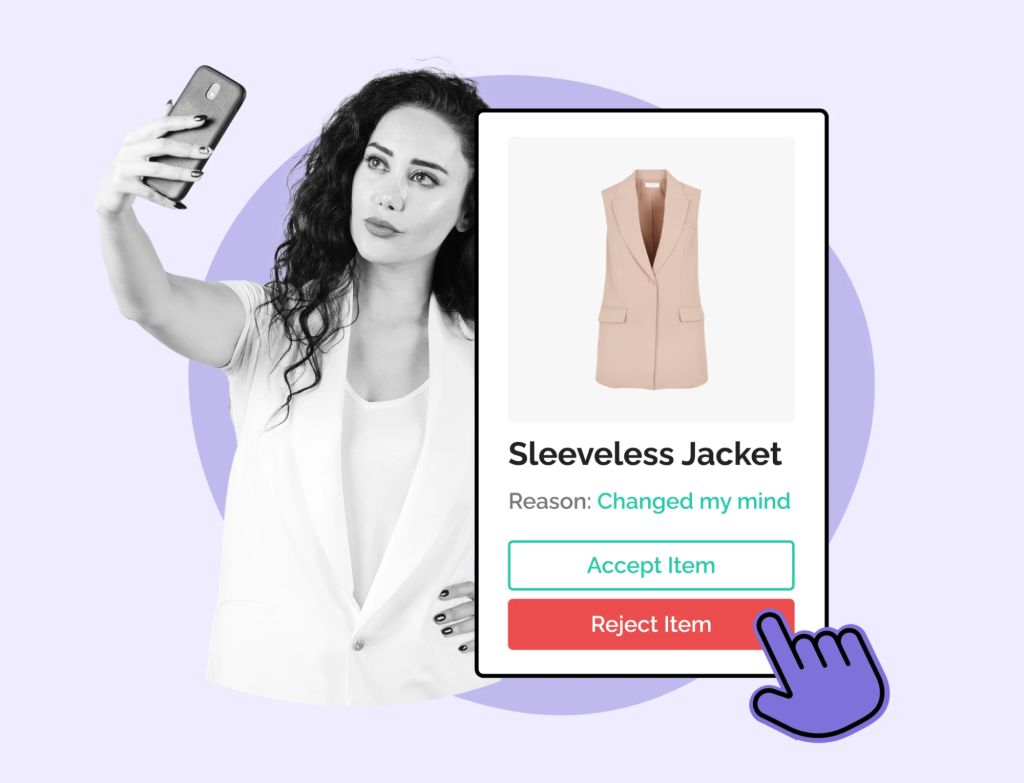

Fraud prevention measures should integrate directly with the return policy. For example, at Walmart, a refund is processed prior to receiving the returned product from the customer. Other retailers may choose to adopt different strategies depending on their risk appetite and business models. Other possible prevention tactics include:

Every purchase and return is unique. Product type, location, and currency can influence how refund requests should be handled. That’s why it’s essential to develop policies that are structured and adaptable to different scenarios.

Ensure that your return policy clearly outlines the following:

Here’s an example of what a clear return policy might look like in practice:

“Customers may return items within 30 days of delivery. To initiate a return, please provide your order number and a photo of the product’s serial number or SKU. All returns must be approved via our Return Authorization Form. Customers are responsible for return shipping costs unless the item arrived damaged or defective. Please ship returns using a tracked service and retain proof of postage.”

Additionally, make certain that your return policy is visible throughout your site. More than two-thirds of customers review return policies before buying. Therefore, if such guidelines are obfuscated or difficult to locate, they may as well not exist.

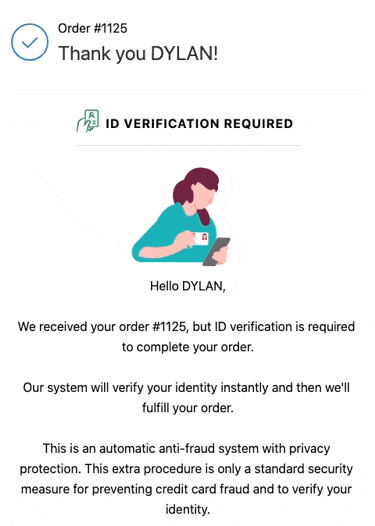

Having to present identification for returns might seem inconvenient; however, such a policy really provides a powerful and effective check against fraud, confirming legal transactions. Everything is in balance; perhaps requiring ID for high-end, over-$200 items but otherwise not creating a headache for most.

If a customer is truly seeking a return, identifying himself will not become a problem because it proves beneficial for both the buyer and the business.

It makes perfect sense that you’re flexible with your customers; this is just building a relationship of trust, strengthening your brand, and creating long-term loyalty. A customer-friendly return policy can actually prevent first-party fraud, as such minor irritations lead many customers to commit refund fraud. Fair and seamless return policies eliminate motivation to engage in dishonest behavior.

However, not every kind of case is the same. These exceptions, like the final sale or non-returnable items, must also be clearly identified in your policy. Customers need to learn such exceptions before they purchase to avoid possible disputes and ensure transparency in dealings.

Returns can be beneficial for sales and customer relationships when managed properly. Would-be returning customers could receive an option to redeem their return for store credit, perhaps with an added bonus, instead of giving the full cash-refund option. This might be a 10% addition to the original price.

Customers using store credits end, in many cases, spending outside the value of the credit that they received, thus increasing sales instead of revenue losses. The involvement of store credits can also ensure satisfaction while minimizing the extent of financial damage due to refunds or return fraud.

Supposing certain purchase orders show suspicious activities in your online store, do not dwell upon it and just suspend the accounts. Such should be further reviewed for additional verification. Should some customers continue exploiting your return policy, block them to avoid further losses and safeguard your business.

Equip your staff with fraud detection training to help them recognize suspicious return attempts. Employees should be aware of high-risk products and maintain detailed records of all returns and refunds to identify patterns of abuse early.

Refining your process on returns will also streamline the efficiency of detecting fraud. For example, weighing returned electronics compared with the original weight can be a way of finding scams such as “bricking,” in which you switch internal parts and return the item.

>>> Read more: Shopify High-risk Orders: Should You Fulfill This Order?

Refund fraud has become a growing issue among online retailers that experience losses and operability problems. Businesses today need to be proactive in putting up fraud prevention mechanisms to detect and capture repeat offenders before the abuse of policies for return occurs.

Blockify puts detection and prevention measures for retailers into action by analyzing behavioral patterns, device data, and historical transactions to recognize high-risk attempts of refund fraud.

Automatically flagging suspicious activity reduces the volume of fraudulent refunds while preserving a seamless shopping experience for legitimate customers using Blockify.

Yes, refund fraud is illegal and sometimes referred to as return or refund theft. This may appear harmless to some, but the authorities see it as theft and fraud for knowingly deceiving the retailer or an online platform for financial gain.

Banks will normally take the loss for a refund but will consider the particulars of the case. If they consider negligence on the client’s part or if the client contributed to the fraud in any way, they may refuse the refund. All cases are treated individually based on the bank’s policies and fraud protection mechanisms.

Yes, retailers do have the right to refuse to issue a refund if certain conditions apply. Many stores have return policies that state certain items are non-refundable, final-sale products, or past the return deadline. Moreover, the retailer would most likely reject the refund if the goods being returned are damaged, missing parts, or fail to meet return qualifications. The return policy must be clear and well communicated by the store as a means of keeping away disputes and fairly processing returns.

Wrap-up

Refund fraud is an increasingly expensive problem for online retailers and continues to choke their revenue flow, inventory management, and customer trust. While fraud methods change constantly, stores must stay ahead by detecting and preventing fraudulent returns. Properly implemented, the strategies will enable the business to bring down the risk of refund fraud while creating a long-term relationship of trust and loyalty.